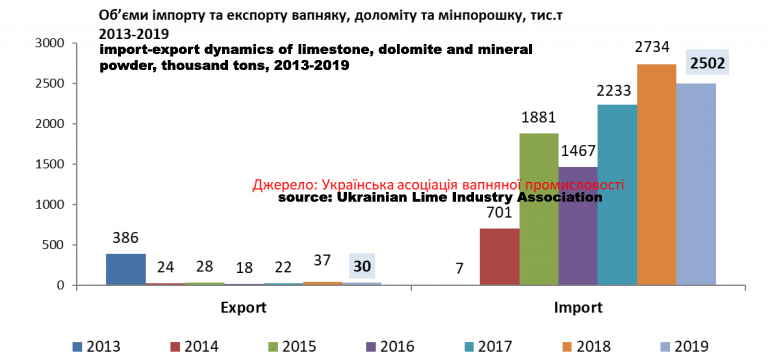

ULIA presents a research of the import-export dynamics of limestone, dolomite and mineral powder in Ukraine according to the results of 2019.

2017 and 2018 were marked by an increase in imports, which was against the backdrop of the loss of control over quarries in the territory of ORDLO and a decrease in domestic production. In 2018, a record 2.7 million tonnes of stone (limestone and dolomite) were imported, exceeding the 2017 level by 22%.

The year 2019 showed a slight decline compared to the previous year: 2.5 million tonnes of limestone / dolomite products were imported in 12 months, which is 9% lower than in the same period last year. It should be noted that the limestone decline is greater (-16%), while the dolomite production shows a significant increase (+ 129%). In December, 56,000 tonnes of limestone were delivered, the lowest in a few years. Overall, during the year, there was a trend towards a decrease in average monthly deliveries of limestone.

Among limestone-dolomite production, the major part is limestone rubble of different fraction, which share has significantly increased in 2017-2018. However, the increase in deliveries of dolomite products (stone + powder): for 12 months its share was 15%, which is equal to the level of 2016, and in quantitative terms exceeds deliveries for the same periods for all previous years. Accordingly, the proportion of limestone production decreased to 85%.

Since 2016, Russia has been the leader in limestone deliveries, accounting for 41% of imports – the share has remained virtually unchanged over the next few years, slightly increasing in 2019 (45%). Elsewhere in 2019, the UAE’s share (from 21% to 10%) and the continued increase in supplies from Turkey, up 25%, should be noted.

Among the industries of imported stone, most of the traditionally metallurgical enterprises. In 2017-18, the share of metallurgy reached its maximum levels of 97-98%, instead, 2019 was marked by an increase in deliveries to lime and glass producers, and the share of metallurgy decreased slightly (95%).

Among the importers since 2017, the IMC named after ILLICH has emerged, which in the following years established itself in the first position. In 2019, the leader’s share was 51%. The year 2019 was also marked by a significant increase in the share of Zaporizhstal, which amounted to 26%, while continuing to reduce imports of the leaders of the previous years of the AMCR: in January-December, the company delivered 10% of imported stone.

The most imported fractions remain such as 20-50 mm, 40-80 mm, 50-100 mm and close to them.

After several years of decline, mineral powder imports rose to 94,000 tonnes in 2018, exceeding the 2017 level by 41%. The year 2019 continued the growing trend: in the first 12 months, 111 thousand tonnes of powder were imported, which is 18% more than last year. Most of the imported powder is dolomite from Belarus.

Content of a full research of import and export dynamics of lime

For those interested, the ULIA offers a complete research, which includes the following documents:

- report (.pdf format)

- database (Excel format) – contains complete information on import-export activity for the period 2014-2019, by section of each delivery, with indication of the Ukrainian importer, foreign supplier, type and fraction of lime, packaging, customs and invoice value, terms of delivery and detailed description of the goods. The database, using Excel tools, provides enough opportunity to obtain detailed information on import-export activities according to the needs of the research customer.

The report contains the following sections:

- Import-export dynamics of limestone / dolomite / mineral powder, thousand tons 2013-2019.

- Imports of limestone-dolomite products: dynamics by types, thousand tons 2016-2019.

LIMESTONE

Import-export dynamics of limestone, thousand tons 2013-2019.

Import-export of limestone, by country of delivery, thousand tons 2014-2019.

Import of limestone stone: dynamics of supply countries, thousand tons 2016-2019

Limestone imports: monthly dynamics, thousand tons 2017-2019.

Limestone import: supplier breakdown, 2018-2019.

Import of limestone: suppliers (detailed), thousand tons 2019.

Limestone imports: Top 7 suppliers by consumer, thousand tonnes 2019.

Limestone import: Consumer import dynamics, 2018-2019.

Import of limestone: importers (detailed), thousand tons 2019.

Import of limestone: industry section, thousand tons 2014-2019.

Limestone imports: fractional dynamics, thousand tons 2018-2019.

Limestone imports: price fractions, 2019, UAH / ton (customs value, DAP).

Arcelormittal Kryvyi Rih: import of limestone-dolomite products in distribution, 2015-2019, thousand tons.

Arcelormittal Kryvyi Rih: import of limestone by section of suppliers, 2018-2019, thousand tons.

Arcelormittal Kryvyi Rih: import of limestone by section of fractions, price dynamics 2019.

Ilyich MMC: Import of limestone by section of suppliers, 2018-2019 (11), thousand tons.

Ilyich MMC: fractional stone imports by fractions, price trends 2018-2019.

Zaporizhstal: import of limestone by section of suppliers, 2018-2019, thousand tons.

Zaporizhstal: import of limestone by section of fractions, price dynamics 2018-2019.

MINERAL POWDER

Import-export dynamics of mineral powder (limestone + dolomite), thousand tons 2015-2019.

Imports of mineral powder (limestone + dolomite): product distribution, thousand tons 2015-2019.

Imports of mineral powder (limestone + dolomite): sectoral section, 2015-2019.

Mineral Powder Exports: Consumer Dynamics, 2018–2019.

Conclusions: Limestone-dolomite products, limestone, mineral powder

If you are interested in obtaining full results of the research, please contact the following contacts:

Hladunenko Roman, CEO, ULIA

phone: +38 (050) 419-75-06

email: info@limeindustry.in.ua